In observance of New Year's Day, we will be closed beginning at 3:00 PM on Wednesday, December 31st through Thursday, January 1st. The stock market will be open normal hours on December 31st and any transfers and exchanges will be processed as usual. We appreciate your understanding and wish you a happy New Year!

As Financial Planners, we try to help you answer two key questions: “Will I make it?” and “Do I have any financial blind spots?” Once you have a plan in place, adapting to changes in the financial landscape becomes much easier. Instead of redoing everything, you just make small adjustments to your plan. Having this baseline becomes even more crucial as we prepare for a potential shift in the tax code when the Tax Cuts and Jobs Act (TCJA) sunsets in 2025.

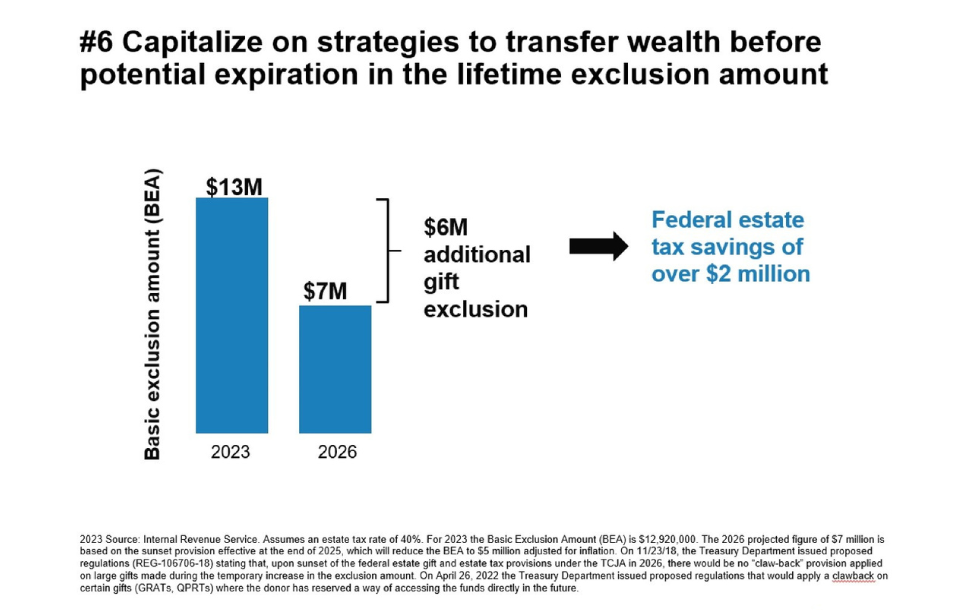

The current tax code has been in place since late 2017 when the TCJA was signed into law. Some key components of the legislation included significantly increasing the standard deduction (by nearly double), capping the state and local tax deductions, doubling the estate tax exemption to $11.2 million for single filers and to $22.4 million for couples, while also continuing to index the exemption levels for inflation. The top estate tax rate remains at 40 percent. Most provisions, including personal income tax rates and brackets, expire at the end of 2025 unless Congress acts. The 21% corporate tax rate and long-term capital gains tax rates do not expire.

the standard deduction (by nearly double), capping the state and local tax deductions, doubling the estate tax exemption to $11.2 million for single filers and to $22.4 million for couples, while also continuing to index the exemption levels for inflation. The top estate tax rate remains at 40 percent. Most provisions, including personal income tax rates and brackets, expire at the end of 2025 unless Congress acts. The 21% corporate tax rate and long-term capital gains tax rates do not expire.

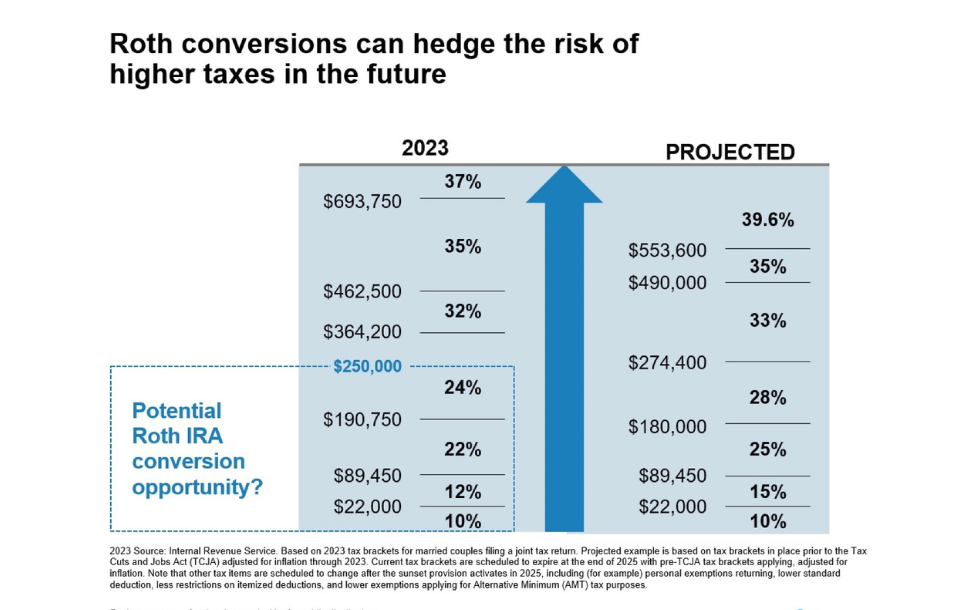

Upon expiration of the TCJA, certain income tax brackets could increase by as much as 9%[i]. Under the current law, these tax brackets would expire at the end of  2025 and be replaced with the tax brackets that were in place prior to the TCJA.

2025 and be replaced with the tax brackets that were in place prior to the TCJA.

Congress could still act before 2025 and extend the current tax structure or make other changes. However, given rising budget deficits and insolvency issues facing major programs like Social Security and Medicare, it’s reasonable to expect higher taxes in the future.

There is still time to take advantage of the favorable tax environment. Here are some planning strategies you may want to utilize under the current law:

Time is our most valuable resource. When you have a financial plan in place, most of the work is already complete. Then, when significant changes are afoot, you have the foundation to help make prudent decisions. If you would like to discuss any of these strategies, please reach out to your Sentinel Financial Planner.

Financial planning and investment advisory services are offered through Sentinel Pension Advisors, Inc., an SEC registered investment advisor

[i] Internal Revenue Service and Putnam research. Projected tax rates are estimated, based on analysis of 2017 tax rates prior to passage of the TCJA, with tax bracket figures adjusted to account for annual inflation adjustments through 2023.

[ii] https://www.irs.gov/publications/p590b#en_US_2022_publink100089543

Images from Putnam Investments.

This website uses cookies. By accepting the use of cookies, this message will close and you will receive the optimal website experience. For more information on our cookie policy, please visit our Privacy Policy.