In election years, we as financial planners often get questions from clients about how November’s results will impact their finances. While these questions often focus on their investment portfolio, the impact of which party is in office extends far beyond just investments. There are other factors that can significantly influence one’s financial plan.

It’s very important to understand that certain things are outside your control. The best we can do is ensure that we have a flexible plan in place that allows us to make swift adjustments. A financial plan should address several key areas: retirement planning, tax planning, risk planning, estate planning, and investment management, to name a few. Once you have a framework in place, you can easily adapt your plan to regulatory changes or developments in your personal life. You might want to review these key financial planning areas as election time approaches.

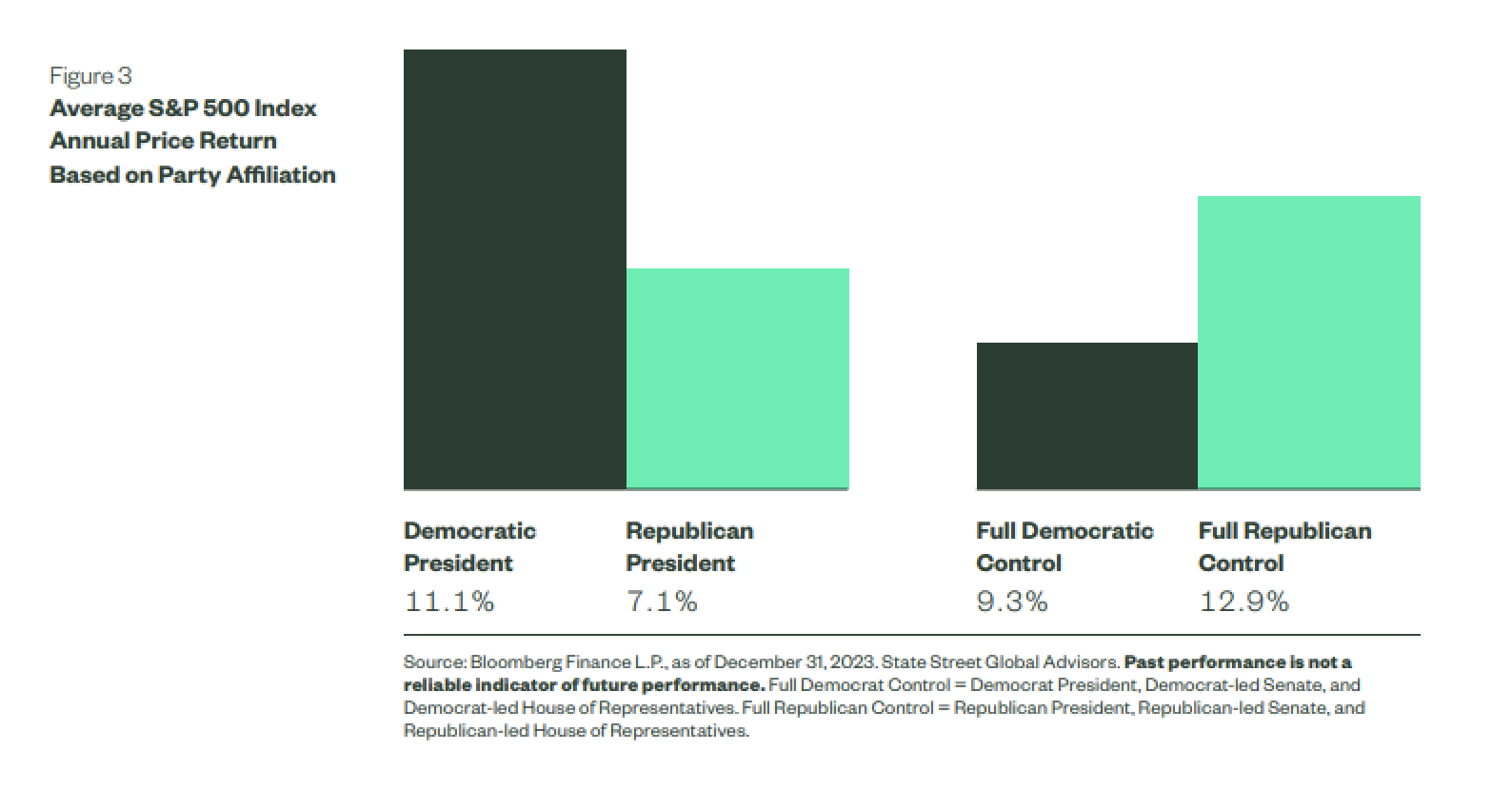

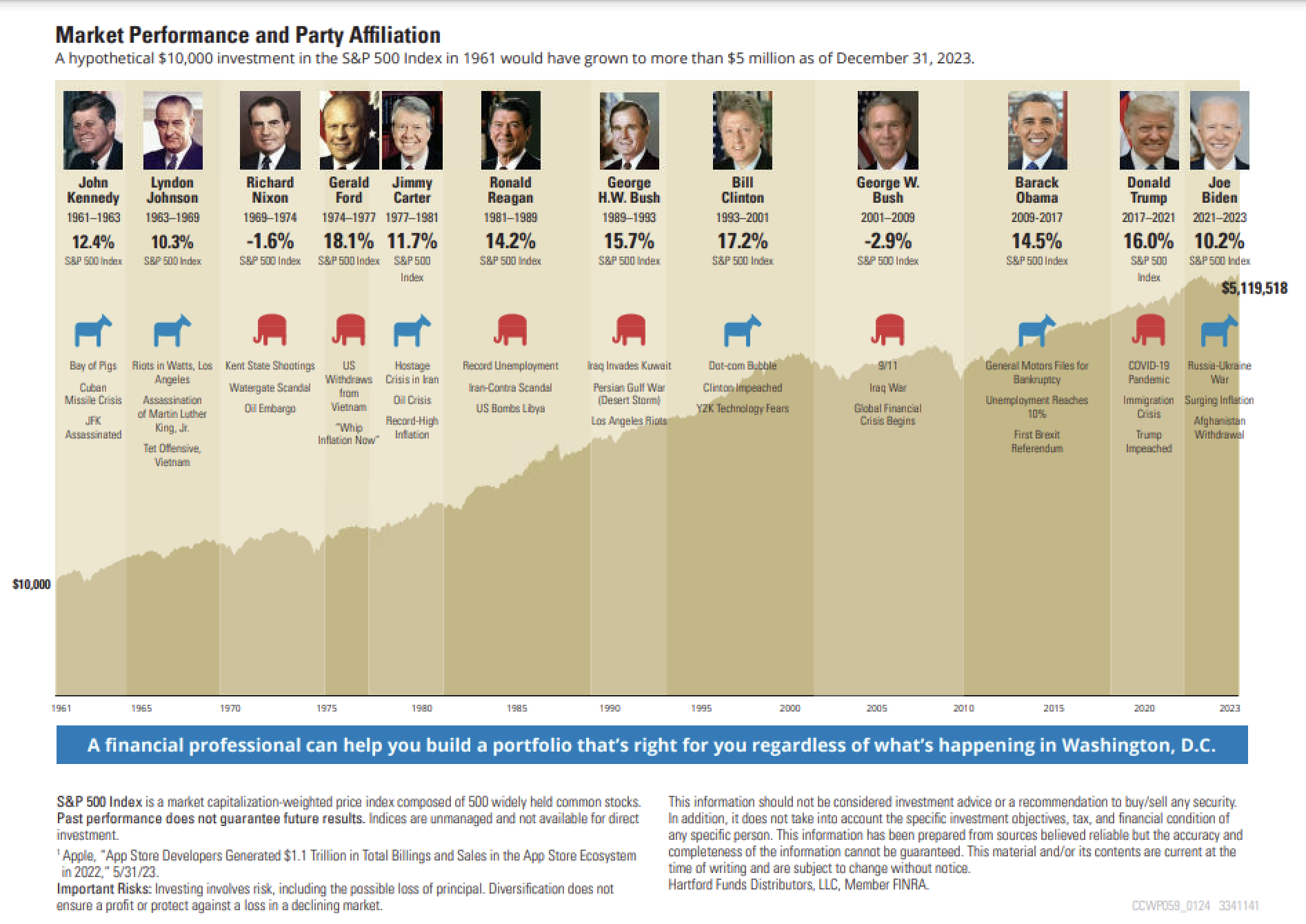

When looking at market performance over the years, it’s hard to find a discernible pattern in performance based on which party holds office.

When looking at market performance over the years, it’s hard to find a discernible pattern in performance based on which party holds office.

For long-term investors, staying invested is important. Volatility can increase in periods of economic and political uncertainty, increasing the impact of poor market timing on portfolios. If that volatility makes you uncomfortable, it might be a good time to reassess your risk tolerance and adjust your allocation accordingly. Nevertheless, it’s important to remember that over time, markets have trended upward regardless of who is president.*

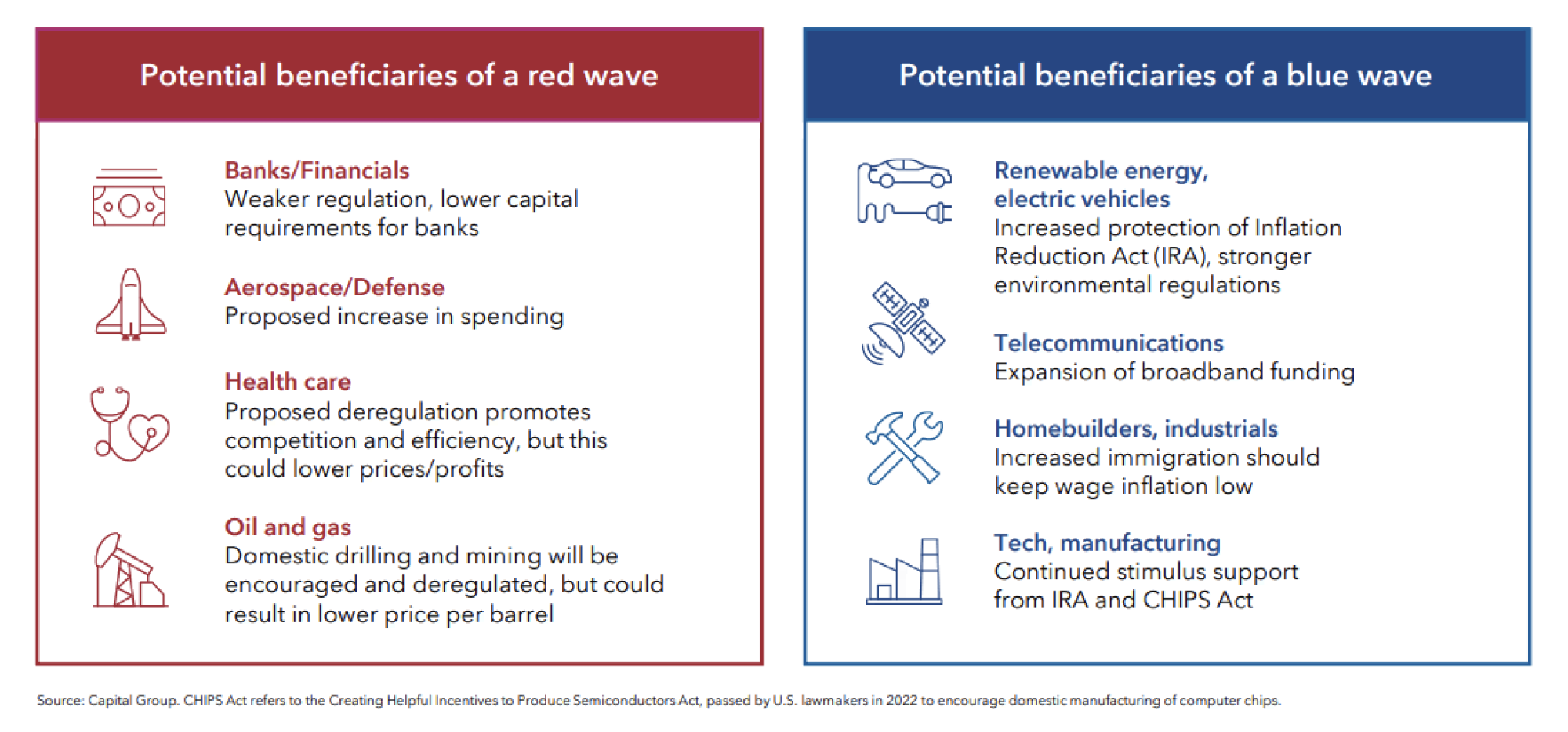

In the short term, there is certainly more potential for sudden bumps (or drops) in sectors based on an incoming president’s political agenda. Some examples: Trump’s intention to increase domestic oil drilling as part of his bid for energy independence and ease regulation in the banking sector could be a boon to energy and financial sectors. Meanwhile, Harris’ stance on immigration and her anti-fossil fuel stance could potentially be a momentum driver for industrials and clean energy.

In the short term, there is certainly more potential for sudden bumps (or drops) in sectors based on an incoming president’s political agenda. Some examples: Trump’s intention to increase domestic oil drilling as part of his bid for energy independence and ease regulation in the banking sector could be a boon to energy and financial sectors. Meanwhile, Harris’ stance on immigration and her anti-fossil fuel stance could potentially be a momentum driver for industrials and clean energy.

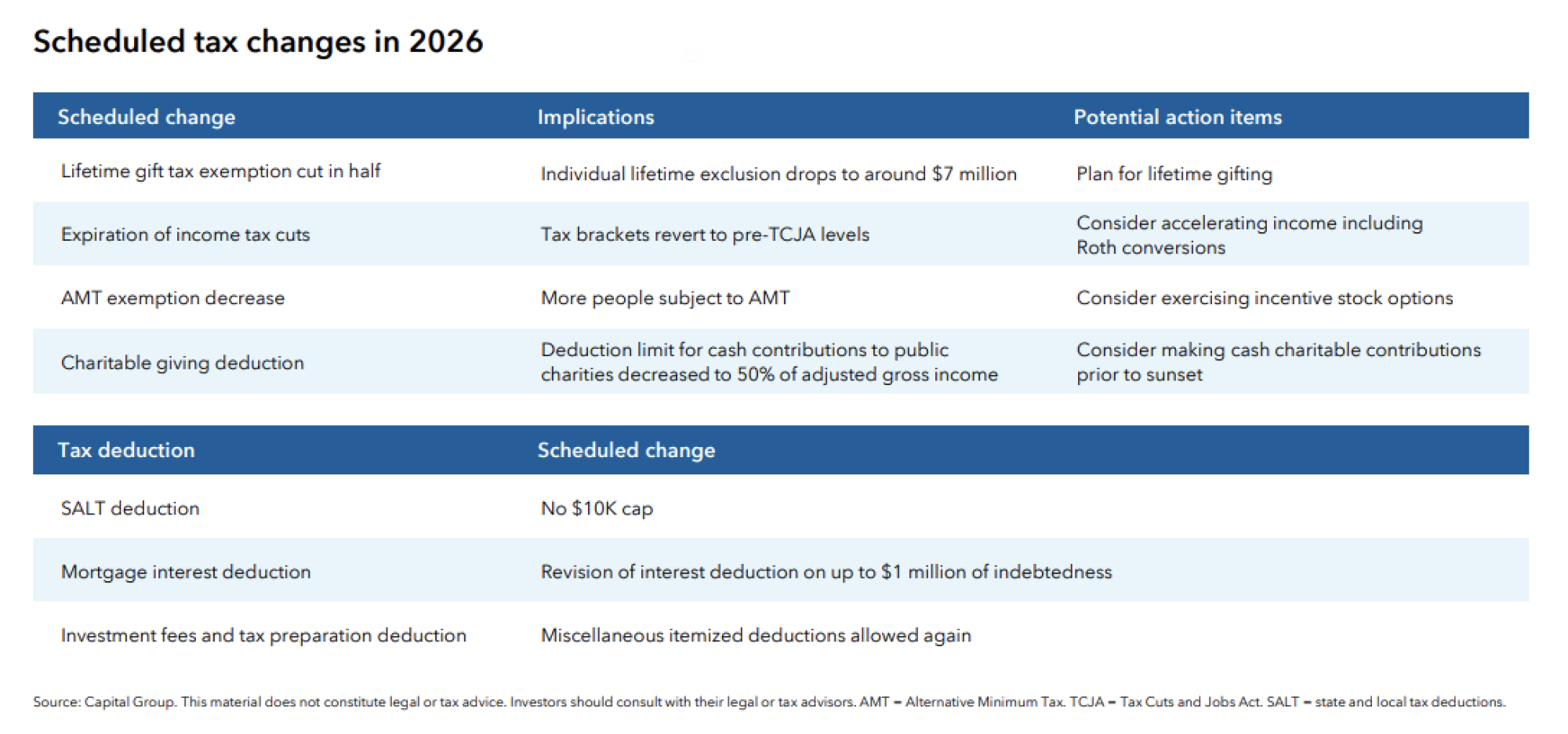

The Tax Cuts and Jobs Acts (TCJA) is set to sunset in 2025, meaning the tax environment could look dramatically different in 2026 if nothing is done. Beyond that, each candidate has their own priorities when it comes to the tax code. Harris intends to raise taxes on corporations and high earners (above $400k) in an attempt to ease the tax burden on the middle class while Trump largely looks to extend the cuts he implemented during his first tour of duty in office. There have also been talks of changes to capital gains taxes and the lifetime gift tax exemption. With potentially major tax changes coming in 2026, 2025 will be an important year from a tax planning perspective.

Beyond that, each candidate has their own priorities when it comes to the tax code. Harris intends to raise taxes on corporations and high earners (above $400k) in an attempt to ease the tax burden on the middle class while Trump largely looks to extend the cuts he implemented during his first tour of duty in office. There have also been talks of changes to capital gains taxes and the lifetime gift tax exemption. With potentially major tax changes coming in 2026, 2025 will be an important year from a tax planning perspective.

If the TCJA is allowed to sunset in 2025, the lifetime gift exemption and estate tax exemption are set to drop significantly. There is also the potential for unrealized capital gains to be taxed (the “wealth tax”).

Estate taxes don't usually drive major tax legislation, but the current favorable environment could be worth considering in some situations.

The outcome of the presidential race is anyone’s guess in such a close contest. Each candidate has their own agendas that could have varying effects on your personal finances. There are also a number of congressional seats up for election that could affect what legislation is actually passed over the next few years.

For investors focused on the long-term, it’s important to maintain that emphasis. However, there may be planning opportunities to take advantage of in the near future. To determine that, it’s important to have a firm understanding of your personal finances.

As financial planners, we start by getting to know you. From there, we help identify opportunities that fit your needs in the ever-changing financial and legislative landscape. Preparing for these moments often starts well before the time comes. Understanding your personal situation will make it easier to plan for different scenarios and allow you to make educated decisions in a judicious manner when the time comes. If you have any questions about how we can help, please don’t hesitate to contact us.

*Past performance does not guarantee future results.

This website uses cookies. By accepting the use of cookies, this message will close and you will receive the optimal website experience. For more information on our cookie policy, please visit our Privacy Policy.